|

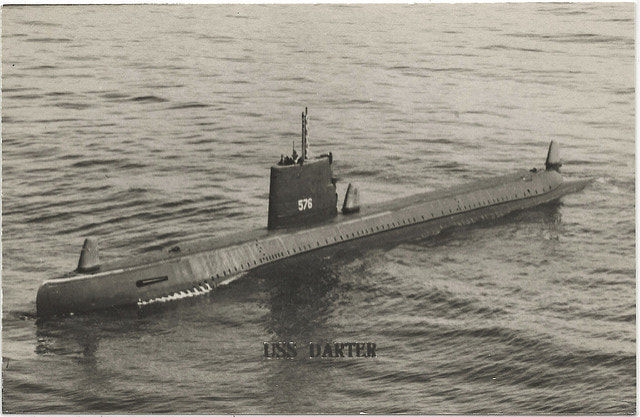

Synopsis: There are two lessons for investors from both victors and vanquished in the final sea battle of World War II. “Conn, Radar…multiple contacts bearing two-zero-zero, thirty thousand yards and closing fast.” CDR McClintock of the submarine USS Darter instinctively scanned the inky gloom off his bow. He could feel the island of Palawan looming to his left as they bobbed silently westward in the South China Sea. Slowly he descended the ladder into his ship and wound he way to the radar station. “Show me.” The operator pointed out irregular sized blobs moving across his plot. Radar was new technology and not always considered reliable. “They could be storm clouds, sir.” McClintock nodded absently. But there are very few straight lines in nature and these radar returns were lined up like...like ships about to pass through a narrow channel. “Storm clouds, hell. It’s the Japanese fleet.” Back on the bridge McClintock barked orders. “All ahead one third, right half rudder, come to one-eight-zero.” He felt the craft slow and gently turn on an intercept course. “Send a message to the Dace, ‘Fast ships on Northeasterly course’, then bring her alongside.” The Dace came up quickly and McClintock saw the face of his old Annapolis classmate Cdr. Clagget, looking at him expectantly. He’d seen the radar plot too and knew exactly what McClintock was thinking. They exchanged a thumbs up. McClintock smiled and shouted “Let’s go!” The two submarines churned onward, prowling on the attack. As dawn approached McClintock gave the order to submerge, the Dace following. At periscope depth he looked out at the massive forms of ships driving hard to get through the straights and into Leyte Gulf where troop transports had been unloading for the invasion of the Philippines. He’d make sure that at least some of them wouldn’t make it. The rest, he assumed, would be mopped up by Admiral “Bull” Halsey and his carrier-based aircraft. “Load tubes one through six.” The torpedoes slid into position and the crew held their breath. When the lead Japanese ship filled the glass of the periscope, McClintock gave the order. “Fire.” Six wakes emerged in the sea running straight and true at their target. In short order, their departure was followed by four immense explosions. “Load the stern tubes and fire as she bears.” More wakes, and more explosions followed. “Well gentlemen, that will do it for the offensive portion of today’s show. Time to run like hell. Helmsman, take her deep.” But before the Darter ran for cover, McClintock risked one last look through the periscope. He was rewarded with the sight of a heavy cruiser burning, black smoke billowing out of her as she began to sink slowly, bow first. He wouldn’t know until much later that he had sunk the Japanese flagship. The first shots of the Battle of Leyte Gulf exposed a major weakness in the Japanese Imperial Navy’s battle plan. Seeking a decisive engagement, they had divided their force into three arms, leaving much of the task force without anti-submarine screens from their destroyers. This was typical of JIN war planners who often relied on perfect timing, uninterrupted communications, and best-case assumptions, none of which were realistic. But the Americans missed an opportunity to completely destroy the Japanese fleet (though they came close) because Admiral “Bull” Halsey wasn’t actually defending the other end of the straight. Always preferring to initiate action rather than play defense, he had chased a diversionary arm of the Japanese fleet north and left much of the coast undefended. The three-day battle from October 23-26, 1944 has two main lessons for today’s investor:

Photo: Bing.com, Free to share and use

Links & Sources:

0 Comments

|

Don't wait for history to happen...Archives

November 2020

Categories

All

|

RSS Feed

RSS Feed