|

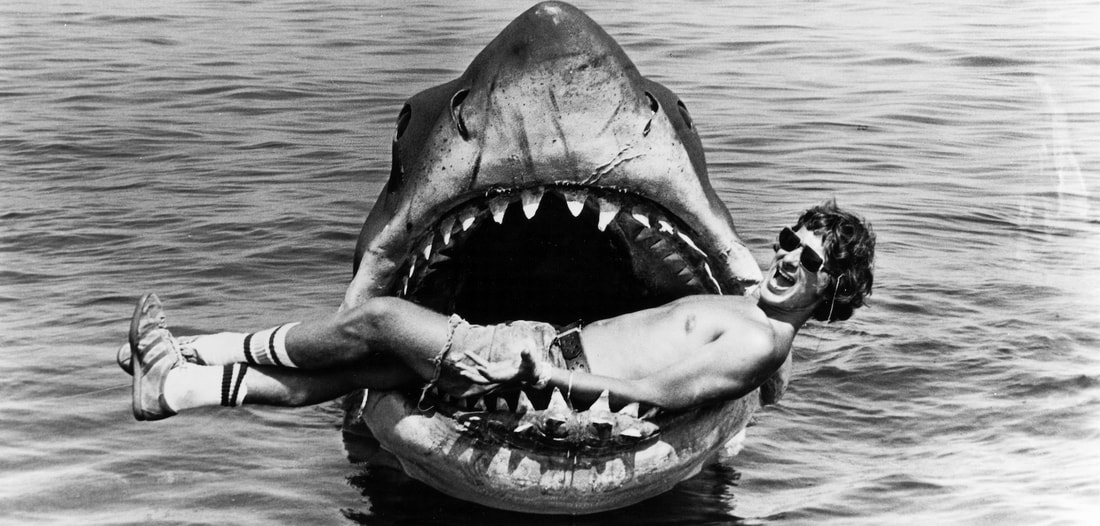

Synopsis: Some events are terrifying enough to make us forget facts and figures, focusing us purely on the potential for pain. But investors need to make decisions based on all the information, not just what is most memorable. “Ha! That’s a good one John. Composer humor, very good.” The director chortled. “What is?” The musician had just introduced a simple ‘ostinato’ of two bass notes, F to F Sharp, repeating it several times. He laid down his baton and crossed his arms. “That music. Very funny.” His mirth was unconventional for a guy filming a horror movie. “Funny?” “Yes…funny. You are kidding right?” “Steve, do you joke about your movies?” The director slowly shook his head, his jocularity morphing into a shallow frown. “Well, I don’t joke about my music.” A silence stretched on between them, the recording studio seeming to become suddenly smaller, warmer and less friendly. The walls closed in and sweat began to bead on everyone’s forehead. John Williams played the notes a few more times. Finally, the director gave in. “Okay then…I guess we have our musical score.” It was a good thing he did. The two note scare tactic worked and made sure that during the summer of 1975, no one else was laughing. Instead, they were terrified and avoiding open water (Da Dum), swimming pools (Da Dum) and bathtubs (Da Dum) because those haunting notes kept reverberating between their ears. The movie Jaws had a modest weekend debut, but the movie sunk its teeth into the American consciousness and on June 29th, 1975 it swam past $20 million in ticket sales in its first full week of release. It would eventually gross $196 million domestically. A full-blown hit, the film changed the way people looked at their beaches and spawned sequels, an entire week of shark programming on Discovery Channel and an episode of Myth Busters. And yes, legend has it that the first time Spielberg heard John Williams’ score, he laughed out loud. Shark attacks are horrific, terrifying and thankfully rare. Why then, do we obsess so much over them? The aforementioned Myth Busters, by the way, found that ten times more people were killed by falling coconuts in a year than by shark attacks. So, this summer, beware of that next Pina Colada! Here is the deal, shark attacks (and movies about them) are traumatic events that cause our brains to overreact and overestimate the perceived threat. This is known as availability bias; overvaluing the likelihood of an event based on its potential for pain or trauma. Indeed, who can forget the scene with the story of the fisherman Quint, captain of the Orca, as relates to his new shipmates the horrors he experienced during the sinking of the USS Indianapolis during WWII. “Over 1000 men went into the water, 316 survivors came out, and the sharks got the rest”. Terrifying? Yes. Historically accurate? Not so much. Indianapolis was indeed sunk by the Japanese in the summer of 1945 (Quint incorrectly says it was June 29th, it was actually July 29th). But, it is believed that a few hundred of the casualties died in the initial torpedo attack and that many more perished due to dehydration after five days floating at sea without fresh water. This didn’t stop the incident from being dubbed “the biggest shark attack in history.” Hollywood rule #1: never let the facts get in the way of a good story. Investors too fall prey to availability bias. Who can forget the blood in the water during 2008’s Financial Crisis? It has been enough to keep some from dipping even a toe into investment waters for a decade despite a historic rebound. Many still fear the downside much more than they enjoy the ups. Why? Sharks, of course! Okay, availability bias. Although past performance is no guarantee of future results, the stock and bond markets have historically provided long term investment growth with a few scary moments along the way. Good investors know they sometimes swim in dangerous waters, but they also know that not every fish is a man eater. Investing rule #1: always let the facts get in the way of a good story. Photo: Bing.com Images- Free to Share & Use

Links & Sources:

0 Comments

|

Don't wait for history to happen...Archives

November 2020

Categories

All

|

RSS Feed

RSS Feed