|

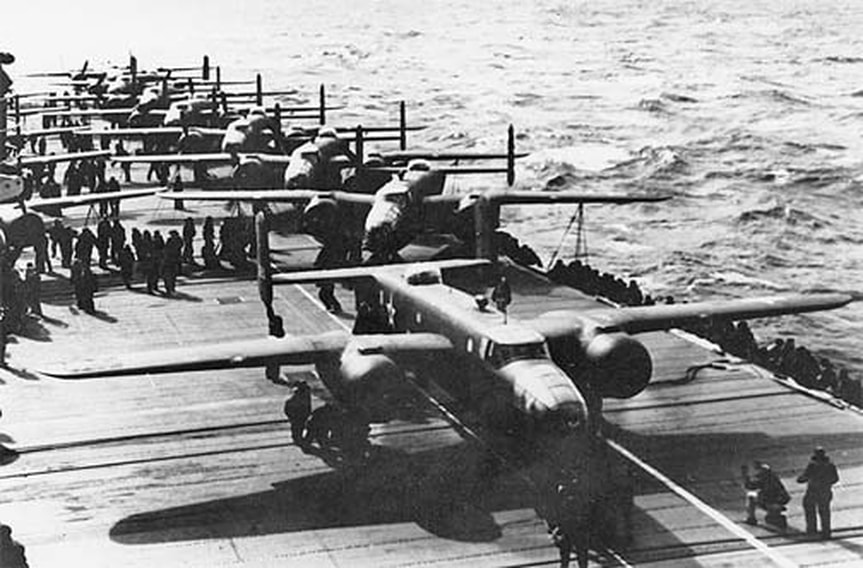

Synopsis: Recent economic numbers are underwhelming, but confidence surveys are increasingly optimistic. Hard data or soft statistics, which one gives a more reliable picture? A WWII bombing operation might give some insight as to where we are heading and what really matters on your own mission. The B-25’s engines droned on and the Pacific slid by two hundred feet below like an endless blue scroll unfurling in front of them. From the cockpit of the lead bomber, the copilot of aircraft number 40-2344, glanced backward over the left and right wings to see a great V shaped wedge of sixteen similar aircraft. Like migrating geese, he thought. Then the call that made his arms turn to goose flesh: “Bandits, two o’clock high. Looks like they are going away from us.” “Zeroes.” Someone else in the formation added, indicating that the planes were the formidable Mitsubishi A6Ms. He stared at the enemy formation, willing them to keep moving up and out over the Pacific. Don’t see us. Come on, let us have one break today. Japanese picket vessels had spotted them aboard the USS Hornet early that morning, and though the Navy made quick work in sinking them, it had to be assumed that the carrier’s presence was known and their element of surprise gone. So, the giant Army Air Force bombers lumbered down the flight deck of the Navy’s aircraft carrier twelve hours ahead of schedule. He’d watched the “boat” as the sailors called it, turn hard after the last launch and steam east, back to base. There would be no landings on her deck after this mission. That, he tried hard not to think about. “They’re turning,” someone announced over the squadron frequency. He tensed and his stomach dropped hundreds of feet to the wave tops below. We aren’t geese… we’re more like sitting ducks. He looked left where his pilot, Jimmy Doolittle, sat looking intently ahead. “No…it was just a sun flash. They are still on the same course,” came a tense, clipped retort. The sun was another issue altogether. The early departure led them to change from a night mission to this assault in broad daylight. But the sun, the mid-day sun, masked them as they flew in from the east. The fighters never saw the formation of bombers, or if they did, assumed them to be Japanese. In moments, they were gone and the great land mass of Honshu Island loomed, a gray brown smudge on the horizon that grew to fill cockpit the around him. Doolittle began a climb to bombing altitude and asked simply: “You ready?” The copilot, Richard Cole, nodded and began adjusting the propeller pitch and coordinating with the bomb crews. In a few seconds, the plane rocked gently and the first red light illuminated on the panel in front of them. “One away.” Three more quickly followed and in thirty seconds it was all over. Doolittle slammed the throttles forward and dove for the deck, the crew watching as black smoke billowed from their targets, now on fire aft of the right wing. Five months after Pearl Harbor, American forces had struck back, hitting targets in and around Tokyo. Doolittle’s Raiders had about six hours to congratulate themselves, continuing westward toward landing fields in China. Then they either crash landed or bailed out after nightfall. Dick Cole gave himself a black eye pulling on the rip cord on his parachute, was met on the ground by Chinese Nationalist sympathizers and reunited with Doolittle. Of the eighty men crewing the raid, eight were captured, one died in captivity and three were killed. Doolittle was distraught, believing that the damage done was insignificant and the loss of men and aircraft meant the mission was a failure. In the card hold arithmetic of war, he was correct. The raid didn’t degrade the enemy’s fighting capabilities much, nor did it permanently damage supplies or material. The hard data would seem to support the pessimistic view. But Doolittle turned out to be wrong. His Raiders were hailed as heroes back home and the mission seen as sending an important mission to the Japanese public. They gave the seemingly invincible forces of the Emperor something to fear. And they gave Americans, still stewing over Pearl Harbor, hope. So, what matters more, hard or soft data? Much of the financial media is asking a similar question today as economic numbers underwhelm, but confidence and survey responses indicate increasingly optimistic sentiment. Here’s how to fly through this tricky period by keeping three things in mind:

Photo: Bing.com Images- Free to Share & Use

Links to Sources: 1) The Doolittle Raid, 1942," EyeWitness to History, www.eyewitnesstohistory.com (2007). http://www.eyewitnesstohistory.com/doolittle.html 2) http://turningpoint1942.org/doolittle-raid.html 3) http://www.cnn.com/2017/04/18/us/75th-anniversary-doolittle-raid/ 4) http://www.doolittleraider.com/80_brave_men.htm 5) http://www.historynet.com/aftermath-doolittle-raid-reexamined.htm

0 Comments

|

Don't wait for history to happen...Archives

November 2020

Categories

All

|

RSS Feed

RSS Feed